What is Discounted Cash Flow (DCF)?

A discounted cash flow is a formula that helps determine the value of an investment by using its expected future cash flows.

Businesses use it when they’re deciding if a project is likely to be financially viable, while it’s also seen as an important tool for analysts and investors.

Key Takeaways

- It’s a valuation method that estimates the value of a business, project, or investment by using expected future cash flows.

- A DCF can help businesses decide whether it’s worth making a new product, buying another company, or expanding into other markets.

- If a DCF of a project is higher than the initial costs involved, then it can be classed as a potentially profitable venture.

- The approach is popular because it uses a wide variety of factors, including profit margins, future sales growth, and the time value of money.

- A DCF does have limitations, such as difficulties involved in predicting future uncertainties that may affect cash flow.

How Discounted Cash Flow Works

The idea is to establish how much an investment is worth based on the amount you expect it will cost and make in the future and then use that to establish its value today.

The DCF analysis estimates the expected return after adjusting for what is known as the time value of money. Let’s explore what that means.

The time value of money refers to the idea that money held now is actually worth more than the sum to be received in the future. This is because money currently held can be invested. You can think of time value in simple terms. Say that someone owes you £100. They can either pay you that figure now or give you £115 in a year’s time. Is this a deal worth taking?

It all depends on whether you can make more money by taking the cash now and investing it. For example, if you can turn it into £120 in 12 months then that’s the route to take.

However, if you won’t be able to generate the same (or more) over that time period, then it’s probably best to delay receipt of the casр as long as they are a good future risk!

Example of DCF Usage

At this point, it’s worth considering when a DCF might be useful.

Here we outline a number of uses of such a calculation:

- Valuing a project or investment opportunity.

- Assessing how much a business is worth.

- Determining the value of a real estate investment property.

- Establishing whether a cost saving measure will be worthwhile.

- To help decide if it’s worth launching a new product.

- Seeing if moving into a new territory will be economically viable.

Understanding DCF Analysis

Over the next few sections we’ll examine DCF analysis from a number of perspectives to establish what it can provide.

We’ll first look at the key components that make up the DCF, then cover the formula required to complete the calculator, and finally some pros and cons to consider.

Key Components of a DCF

There are three key elements involved in a DCF calculation:

DCF Calculation

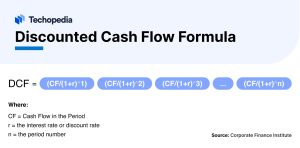

Next we consider the answer to the question: what is a discounted cash flow model? There are a number of sums that can be used to establish the DCF.

Here is one example:

Of course, there are ways to establish the DCF without having to complete a manual sum. For example there is this online calculator that you can use.

What is the DCF Formula Used For?

The DCD formula is used to determine the value of a business, investment or project to see whether or not it’s likely to be successful.

The formula used helps to establish the amount someone would be willing to pay for it, based on the rate of return needed.

DCF vs. NPV

So, how about DCF and NPV, which is known as net present value. Are these two terms the same or are there fundamental differences?

The reality is that they’re closely linked but certainly not identical. NPV adds another layer to the overall calculation in so much as it deducts the upfront cost of the investment.

Discounted Cash Flow Analysis Pros and Cons

Of course, nothing in life is perfect. So, what are the various pros and cons of DCF analysis that you need to bear in mind?

Here are some of the main ones:

- It’s an established tool that’s used regularly

- Figures used are very detailed

- Includes many assumptions about a business/project

- Helps to determine the value of an investment

- Can highlight potentially bad future value

- It can be a complex calculation

- Risk of it being sensitive to assumption changes

- Possibility of errors being made

- Inability to account for left field events

- Uncertainties in cash flow projections

The Bottom Line

The most accurate discounted cash flow definition is that it’s a way to determine the value of an investment by using expected future cash flows.

This calculation can be useful to a wide variety of people. For example, businesses may turn to the DCF before deciding whether to embark on a new direction.

As we have discussed in the definition, DCF is a favoured analysis tool because it takes into account a wide variety of factors, such as profit margins and future sales growth.

However, there are potential problems. For example, if an investment or project is particularly complicated then a DCF approach may prove to be inaccurate.

FAQ

What is discounted cash flow (DCF) in simple terms?

What is the difference between NPV and DCF?

What is a good discounted cash flow rate?

How is DCF calculated?

References

- Discounted Cash Flow Calculator (DCF Calculator) (GIGA Calculator)

- Discounted Cash Flow DCF Formula (Corporate Finance Institute)