Scammers are constantly inventing new ways to steal people’s money, and the enormous growth of cryptocurrencies brings new opportunities for fraudsters to develop innovative swindles.

That’s why if you’re interested in cryptocurrency, it’s important to be aware of the risks. To keep you from falling victim to these bad actors, we’ve compiled this guide to help you identify common cryptocurrency scams and learn how to avoid them.

How to Identify Fake Cryptocurrency

“Stripped of their mystique, cryptocurrencies are products theorized and built by people. Before being brought to market, a project’s functionality and scope of growth are first clearly laid out in a proposal or white paper,” says Mark Taylor, head of financial crime at cryptocurrency exchange CEX.IO.

This white paper should include potential use cases and define how the project will achieve security, transparency, scalability, and decentralization.

“Bitcoin famously appeared as a nine-page document before debuting as a network,” he adds. “Although dense, these can be invaluable resources for understanding the inner workings of a digital asset and the company’s long-term vision for its design and implementation.”

Since the crypto industry is still developing, many projects are predicated on a later, grander promise, Taylor says.

“To get a real-time glimpse of how progress is coming along, observe the community that emerged around the project,” he says.

“Like brand loyalists, crypto enthusiasts can also feel a sense of camaraderie around their particular assets and help sustain buzz around landmark advancements. This can also be a sound environment to gauge whether project claims live up to user expectations.”

Then there’s the technical side of things.

“While not reliable as lone indicators, parsing an asset’s market capitalization, transaction data, total value locked, and other on-chain metrics can combine to give a fuller picture of its overall health,” Taylor says.

While this can require a more trained eye, there are countless educational resources available throughout the ecosystem that can help participants get up to speed on industry processes.

“Taken together and coupled with a personal risk assessment, these steps could help weed out potential pitfalls in an increasingly crowded market,” Taylor says.

“Do your due diligence.”

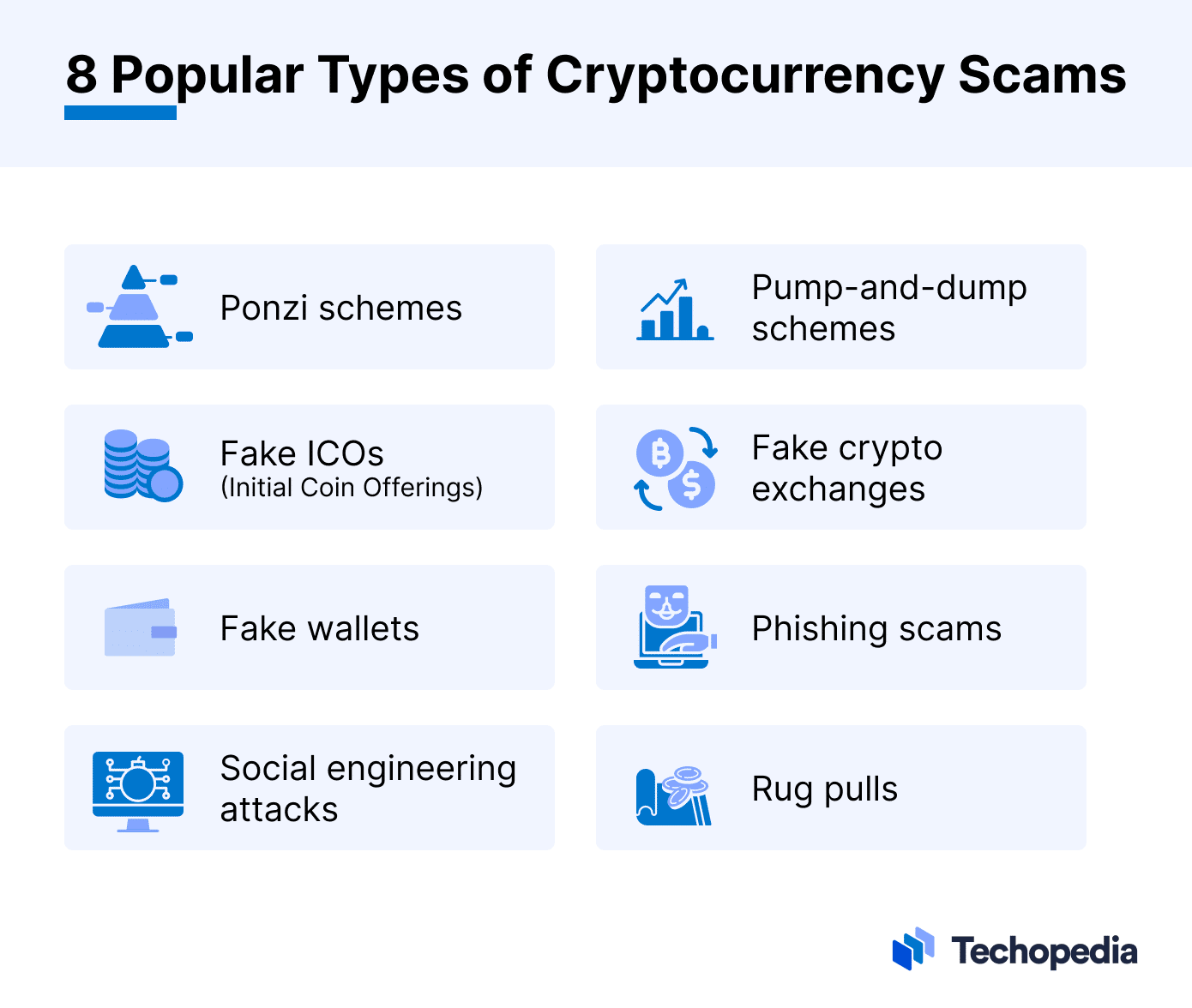

8 Popular Types of Cryptocurrency Scams

There are many ways bad actors can attempt to siphon off your hard-earned wealth, many of which have been fine-tuned over the years in traditional financial markets, according to Mark Taylor.

“Promises of high-yielding investments that are typically at the heart of Ponzi and other scams may just be a way to lure you into sharing bank account details, credit card numbers, etc.,” he says.

If you’re wondering how to spot a crypto scammer, you should be aware of these eight popular cryptocurrency scams:

Ponzi Schemes

Taylor says that Ponzi schemes rely on the continuous growth of new investors (or marks) to pay the original investors and so on.

“While there’s often snappy marketing campaigns propelling the companies or tokens behind these grifts, often the businesses or assets themselves either never truly existed or functioned exclusively to enrich their creators,” he says.

Pump-and-Dump Schemes

In pump-and-dump schemes, fraudsters hype specific coins or tokens via social media or email blasts. Traders then rush to purchase the coins since they don’t want to miss out, thereby increasing the price. After they’ve inflated the prices, the scammers dump their holdings. This causes the value of the assets to decline dramatically, resulting in a crash.

Fake ICOs (Initial Coin Offerings)

Some bad actors design fake cryptocurrency websites for ICOs and then direct investors to deposit cryptocurrencies into compromised wallets. Other times, it may be the ICOs’ fault as founders could misrepresent their products to users via false advertising or distribute unregulated tokens. Therefore, it’s imperative to make sure that it’s a legitimate ICO crypto that you’re investing in.

Fake Crypto Exchanges

Fraudsters sometimes create fake versions of official cryptocurrency wallets or crypto exchanges to trick users.

These scammers then reel in investors by promising free bitcoin (BTC), for example, to get them to sign up for their exchanges. However, after they make their deposits, investors discover that they have fallen victim to a bitcoin scam.

Fake Wallets

Fraudsters use fake wallet scams to dupe investors into thinking they’re storing their assets in legitimate digital wallets. Scammers ask investors to enter their private keys, then they use those private keys to steal investors’ crypto holdings.

Phishing Scams

In this scam, fraudsters try to trick users into divulging their crypto wallet private keys, the keys necessary to access cryptocurrency.

As with standard phishing scams, these scammers send emails to crypto holders that contain links that send them to fake websites and ask them to enter their private keys. Once they have this information, the scammers can steal users’ cryptocurrencies.

Social Engineering Attacks

Crypto scammers use many of the same tricks they use to con people in the business world into providing their personal information, including social media engineering scams, hacking, and phishing scams.

Investors should be careful on social media as scammers may set up imposter social media accounts and contact users asking for deposits or investments, only to take their money and disappear.

Rug Pulls

Rug pulls can occur early in an asset or company’s life, where a builder will make lavish promises to raise money and investor confidence, only to cut and run without delivering a finished product, says Taylor.

Red Flags to Consider When Choosing Crypto to Invest in

Researching projects before putting funds on the line is a great way to “suss out” potential hazards, according to Taylor.

Taylor advises investors to assess the overall quality of the project’s website, and before initiating any transactions, curious participants should consider the following questions:

- Do the pages look and feel professionally done or hastily thrown together?

- Are there discernible spelling or grammatical errors in the copy or the project’s white paper?

- Does the project’s plan align with our shared understanding of reality?

- Can you locate the company’s terms of use, privacy policy, and current licensure?

- Do they seem overly concerned with promotional content rather than measured materials encouraging users to make informed decisions?

“After giving the project’s website a thorough once over, move over to their social media presence to adjust your vantage point,” Taylor says.

- Evaluate how the company presents itself to users across different channels.

- Check follower counts, engagement, and the type of content being shared on each channel.

- Look for divergent traits. If the same company presents itself radically differently between Twitter and LinkedIn audiences, that mercurial nature could be masking a more sinister intent. In turn, taking a moment to browse the overall timbre of an asset’s community can reveal their level of satisfaction with the project.

“Despite a certain amount of anonymity, crypto is transparent down to its most granular details,” Taylor says.

“While it may seem confusing from a bird’s eye view, engaging and sharing resources with other trusted participants is a great way to build the knowledge base necessary to achieve a more nuanced understanding.”

Do Your Own Research (DYOR) and Due Diligence

“On a micro level, project white papers and any associated websites or materials therein are great places to begin when looking to understand individual assets,” Taylor says.

Additionally, third-party aggregators and ranking sites can provide clear-eyed insights to help corroborate that information.

“While a project’s site would have a vested interest in its success, these added vectors can puncture that veneer if necessary,” Taylor says. “These resources can also help point you toward vetted, regulated exchanges to ultimately facilitate your crypto transactions.”

Often, exchanges function as ecosystems in their own right, with various amenities at the community’s disposal.

“Their position within the broader industry can lend an impartial glaze to their offerings. Rather than championing individual projects, exchanges are typically concerned with increasing access to, and the proliferation of, crypto services. And achieving more widespread digital asset adoption will only occur alongside a robust educational undertaking.”

For example, he says CEX.IO University is a free hub for acquiring crypto knowledge and features a complete glossary of industry terms. The CEX.IO research team also produces quarterly COMPASS reports tracking developments and macro trends impacting the industry.

“That being said, participants are encouraged to find the tools and pathways they trust that map best onto their unique crypto journey,” Taylor says.

“While accrued knowledge and current, up-to-date information can help mitigate some level of risk, controlling for all outcomes is impossible. Therefore, it’s crucial those who choose to participate conduct ongoing risk assessments and stay on top of market movements to remain vigilant.”

The Bottom Line

Crypto fraud continues to increase as scammers devise more personalized and complex schemes comprising layers of deception. And as crypto scams become more elaborate, so, too, do the amount of losses investors incur.

However, if investors are aware of the warning signs of cryptocurrency scams and take preventive actions, they’ll likely save themselves some heartache, not to mention money.

Investors navigating this complex world of cryptocurrencies must educate themselves to understand how these digital assets work to make informed decisions, spot potential scams, and protect themselves and the crypto community from fraudsters.