What is Inflation?

Inflation is the increase of prices across a broad range of goods and services, known as a basket, in an economy, over a given period of time. This is usually a year, but can also be monthly or quarterly.

This results in the reduction of purchasing power over time, as the same amount of money consistently buys fewer units of a good or service over the years. As a result, the cost of living also increases.

Core inflation is more specific and excludes food and energy prices from the basket of goods. This is because food and energy prices can usually be quite volatile and, as such, may not accurately indicate the level of inflation currently present.

An ideal amount of inflation may have advantages such as increasing property or commodity prices. However, out-of-control inflation usually causes more harm than good.

Causes and Examples of Inflation

At its core, inflation is caused by a rise in money supply, supported by loose monetary policy. This can be done through:

- Printing more money

- Purchasing more government bonds

- Legally devaluing a country’s currency.

These measures all contribute to a particular currency losing its purchasing power.

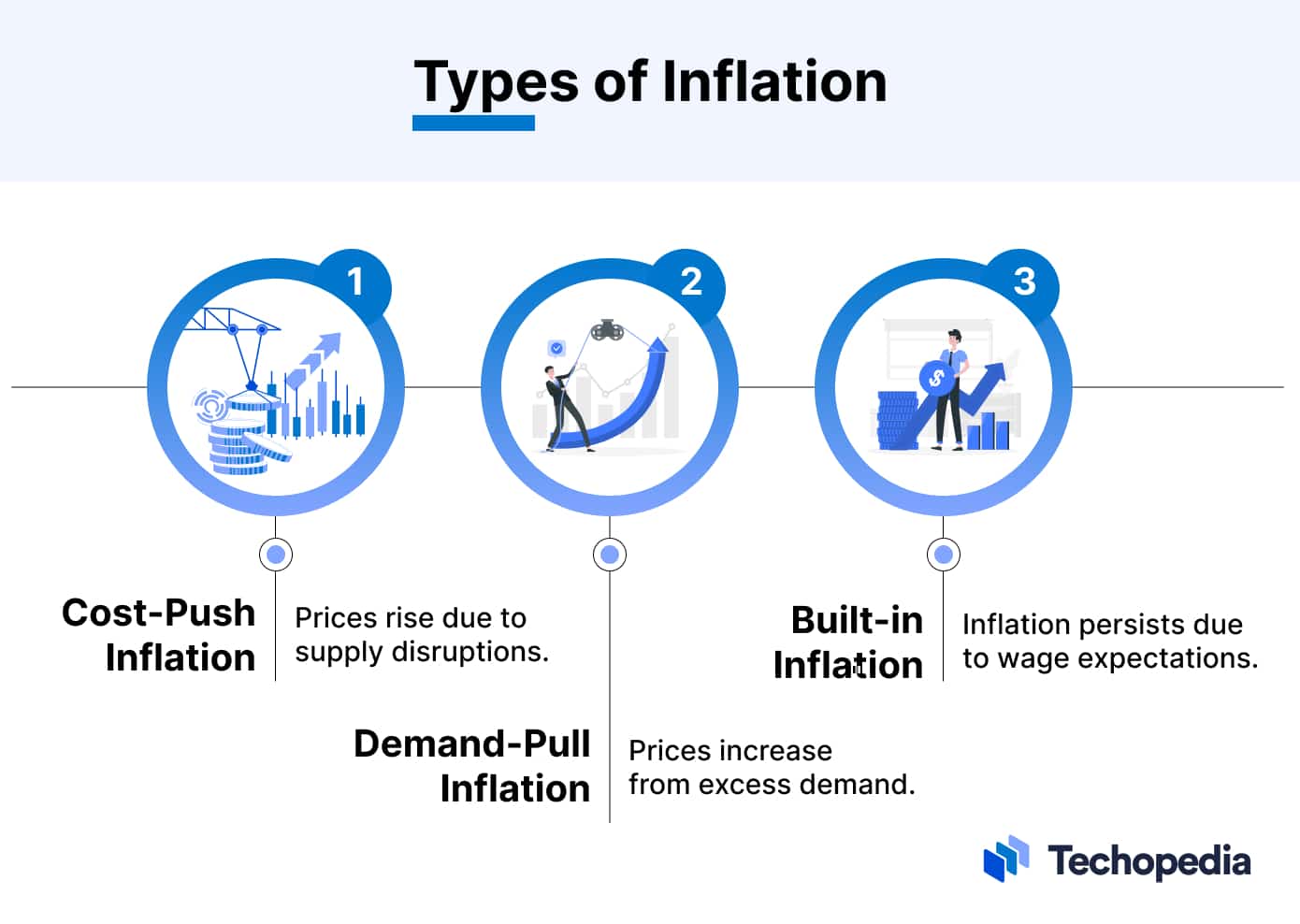

This, in turn, leads to a variety of inflation types, as highlighted below.

Cost-Push Inflation

This happens when there are supply shocks in an economy that upset production. Those can be in the form of geopolitical events such as the Russia-Ukraine war, which disrupted energy and metal prices. Natural disasters can also cause supply shocks.

As production and supply chains are disrupted, input materials for goods become more expensive. This raises the price of manufacturing, forcing producers to pass on the costs to the final consumers.

This is what happened during the global financial crisis in 2008, with soaring food and fuel prices bouncing around from country to country due to trade.

Demand-Pull Inflation

This occurs when the economy faces a sudden shock or increase in demand. It can be through expansionary policies like governments increasing spending. Demand shocks can also occur through stock market rallies or if a central bank drops interest rates.

This may create an unprecedented rise in demand, which may be beyond a country’s production capacity. Since the number of goods and services is now limited and less than demand, this results in higher prices, leading to inflation down the line.

One example of this was the pent-up demand for the travel and hospitality sector once COVID-19 restrictions loosened in several countries.

Built-in Inflation

This refers to the people’s expectations that inflation will continue to rise at more or less the same rate for the foreseeable future. This is especially true if it has already been there for the last few years.

To prepare themselves for the same, individuals may expect higher salaries so that their living standards stay the same.

This leads to goods and services becoming more expensive as labor costs increase, thus also leading to inflation and causing a vicious cycle.

How do Inflation Indexes Work?

Inflation is measured using a range of different price indexes. These depend on the particular goods and services selected.

Consumer Price Index

One of the most commonly used is the Consumer Price Index (CPI).

This index takes into account consumer or final goods and services targeted toward individual or non-institutional consumers. This includes food and non-alcoholic beverages, clothing and footwear, transport and healthcare.

These goods consider retail prices. The price changes for each good are averaged based on their relative weight in the basket.

Some key factors are considered while deciding upon goods and services for the CPI basket. These include:

- Their availability throughout the year.

- The average amount spent on them.

- How variable the price of a certain good is.

Producer Price Index

The producer price index is mainly used in the U.S. It looks at selling price changes faced by domestic manufacturers of intermediate goods and services.

It is a compilation of hundreds of indexes looking at producer prices across various product categories and industries.

Wholesale Price Index

The wholesale price index is quite similar to the producer price index. Several countries substitute it for the latter. It looks at price changes in wholesale goods or goods that are before the retail stage, such as cotton yarn, fuel and power, and so on.

How to Control Inflation

A number of countries usually have an inflation target that they try to aim for, such as 2% in the UK. In order to handle higher-than-anticipated inflation, central banks have a number of strategies to try and bring things back under control and closer to the target.

These include:

Tightening Monetary Policy: Central banks can tighten monetary policy by hiking the reserve requirements for banks They can also reduce currency supply by selling a higher number of government bonds.

Currency Market Intervention: Central banks do this directly or indirectly. Direct methods involve central banks actively buying up their own currency in foreign exchange markets. This, in turn, causes the currency to appreciate. Banks use central reserve funds to achieve this.

Indirectly, central banks can influence a currency’s value with signals that it is undervalued. This helps to reduce import prices.

Hiking Interest Rates: This results in borrowing becoming more expensive, which in turn can slow down inflation by bringing down consumer spending.

However, inflation control measures, such as monetary policy tightening, can sometimes go too far. These can lead the economy to the brink of recession and cause higher unemployment and declining economic growth.

Hyperinflation

The definition of hyperinflation refers to very fast and extremely high inflation in a country. This can take place over a month or even over a few days. Usually, hyperinflation is when prices increase more than 50% in a month.

Once started, it can quickly become out of control. When central banks print too much money without corresponding economic growth, it leads to hyperinflation.

Out-of-control demand-pull inflation can also lead to hyperinflation, especially if there are not enough goods to meet the sudden spike in demand. This can cause price surges for goods such as fuel and food, leading to hoarding.

Hyperinflation is usually quite rare in developed economies. However, it has happened in countries like Chile, Russia, Georgia, Zimbabwe, Brazil and more.

Inflation Hedges

Precious metals such as gold and silver have long been considered hedges against inflation. This is due to several factors, such as precious metal prices being less volatile than that of stocks or other assets, which are typically more impacted by inflation.

Inflation erodes the value of fiat currencies like the US dollar by reducing purchasing power. Thus, it makes precious metals more valuable for those who have already invested in them. This is because one troy ounce of gold and silver now costs more dollars or other currencies.

Precious metals also have tangible uses, especially in industries like jewelry, automobiles, electronics, and more. Hence, they will always be in demand. Unlike fiat currencies, precious metals are also limited in supply.

However, investing in gold does have its downsides. These include storage costs, lost compound interest, and high capital gains taxes, amongst others. Thus some investors consider U.S. Treasuries, especially Treasury Inflation-Protected Securities (TIPS), to also be good inflation hedges.

Treasuries are more secure at times and also pay higher rates. Exchange-traded funds (ETFs), which invest in both gold and Treasuries, may also be good options.

Of late, there have also been debates about the merits of cryptocurrencies like Bitcoin (BTC), over gold, as inflation hedges.