What is an Interest Rate?

An interest rate is the amount charged by a lender to a borrower for the use of assets during a certain period. It is expressed as a percentage of the principal, which is the amount borrowed. Interest rates compensate lenders for the risk they take.

Interest rates apply to most lending transactions and are a key business concept. Different factors impact interest rates charged to borrowers.

How Do Interest Rates Work?

When an individual or business borrows money, they receive the principal amount, which must be repaid to the lender in the future. In addition to repaying the principal, the borrower must also pay interest on the loaned amount.

For example, if $100 is borrowed at a 5% annual interest rate, the borrower must repay $105 to the lender by the end of the year. This is the original $100 in principal plus $5 in interest for using the money.

The interest payment compensates the lender for both the opportunity cost of not being able to use the money during that period and the default risk assumed.

Interest rates are typically expressed as an annual percentage rate (APR) – the cost of borrowing money on a yearly basis. Other common interest rate terms include simple interest, compound interest, nominal interest, real interest, and effective interest.

Lenders assess the risk profile of borrowers to determine what interest rate to charge each of them. Lower-risk borrowers receive lower interest rates, while higher-risk borrowers pay higher rates.

External factors like monetary policy changes also impact prevailing interest rates.

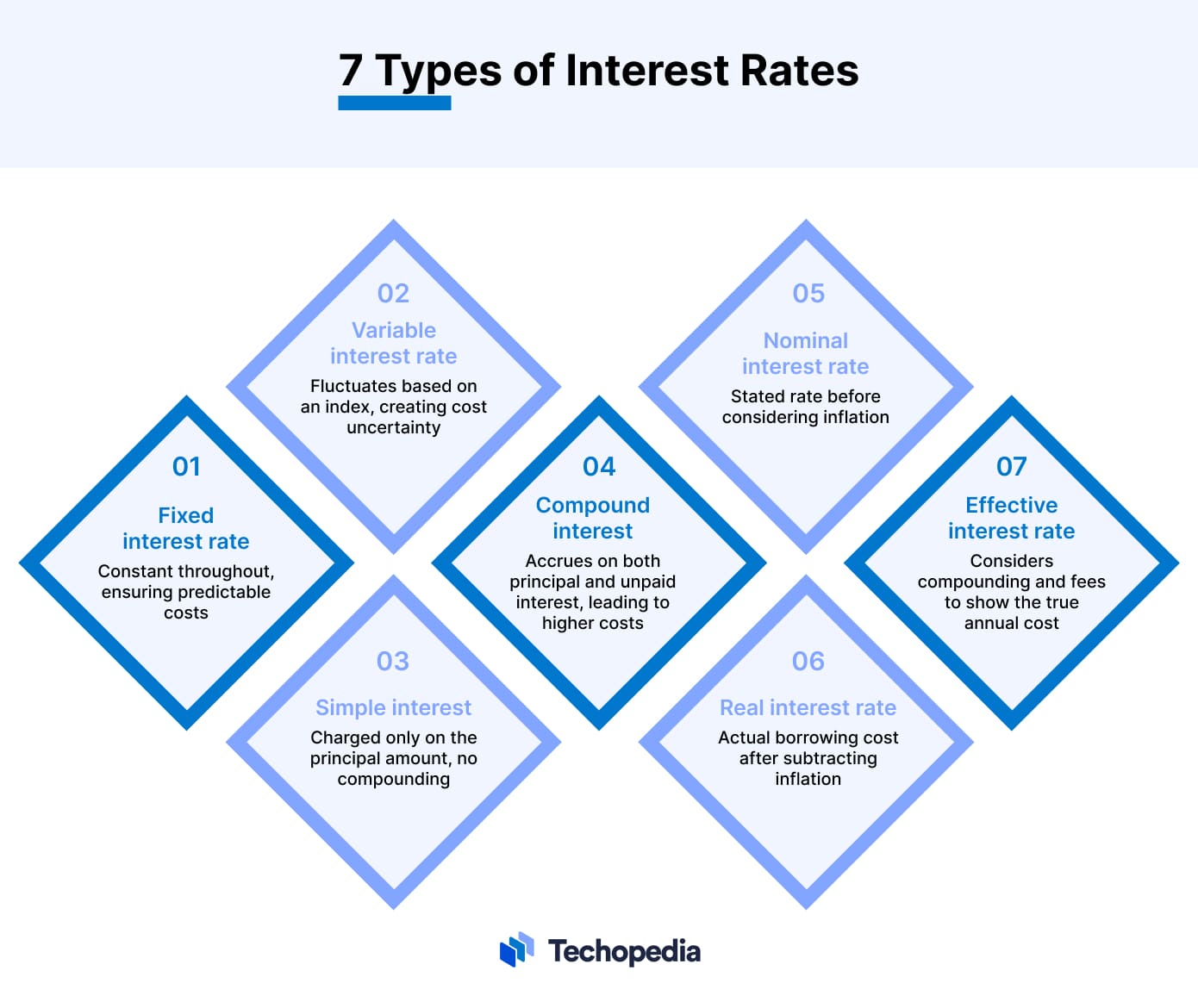

7 Types of Interest Rates

- Fixed Interest Rate: Remains constant over the full term of the loan. Provides predictable interest expenses.

- Variable Interest Rate: Fluctuates over time based on an underlying index rate. Introduces uncertainty to the borrower’s expected financing costs.

- Simple Interest: The interest is charged only on the principal amount. It does not compound over time.

- Compound Interest: Interest accrues on unpaid interest and principal. It results in higher long-term interest costs.

- Nominal Interest Rate: The stated interest rate before factoring in inflation. It may differ significantly from real interest rates if inflation is high.

- Real Interest Rate: The nominal rate minus the inflation rate reflecting the true cost of borrowing.

- Effective Interest Rate: Factors in compounding and fees to show the true annual cost of borrowing.

Factors Impacting Interest Rates

- Creditworthiness: Interest rates typically fall as the creditworthiness of the borrower improves. A borrower’s payment history and other similar factors dramatically affect his/her perceived creditworthiness. In practice, it is typically gauged by using credit scores.

- Default Risk: The risk that the borrower will not repay the loan influences interest rates. Higher default risk results in higher rates.

- Term to Maturity: Longer loan terms tend to have higher interest rates due to increased risk over time. Short-term loans often carry lower interest rates in most cases.

- Inflation: When inflation is high, lenders increase interest rates to offset the diminished purchasing power of the money they loaned.

- Liquidity: When more liquidity is available to provide loans, interest rates tend to decrease due to natural supply and demand dynamics.

- Monetary Policy: Central bank policies like rate cuts or quantitative easing reduce interest rates economy-wide by increasing liquidity.

How Do Interest Rates Affect Different Economic Agents?

For borrowers, interest rates determine the cost of financing expenses and business investments through loans. Lower rates reduce borrowing costs, while high interest rates make capital investments more expensive.

For lenders, higher interest rates allow them to produce higher profits on the loans they provide.

Meanwhile, consumers benefit from lower rates since mortgages, credit cards, and other credit instruments carry a lower financing cost. Meanwhile, retirees and savers earn less interest income on deposits and fixed-income investments when rates are low.

The Role of Central Banks and Their Influence on Interest Rates

Central banks like the Federal Reserve influence interest rates through monetary policy actions. By changing key rates like the federal funds rate in the United States, they impact rates throughout the economy.

Lowering rates boost lending, investment, and economic growth by making the cost of borrowing cheaper for both corporations and consumers. Raising rates slows growth and controls inflation by making money more expensive.

Central banks analyze economic indicators like unemployment, inflation, and GDP growth to determine if rate hikes or cuts make sense based on current conditions, outlook, inflation targets, and growth objectives. Their goal is to stimulate growth during recessions and contain inflation during expansionary periods.

How Do Changes in Interest Rates Affect the Economy?

- Consumer Spending: Lower rates make goods like cars and homes more affordable by reducing borrowing costs.

- Business Investment: Low interest rates incentivize business borrowing and capital investments in things like equipment and buildings.

- Inflation: Falling rates can stimulate excess demand and lead to higher inflation. Rising rates help control inflation by slowing lending and economic activity.

- Asset Prices: Lower interest rates make stocks and real estate more attractive relative to fixed income as yields on savings accounts are lower. Investors are forced to take higher risks to pursue higher returns.

- Exchange Rates: Rate cuts tend to weaken a country’s currency by pushing investments abroad. Meanwhile, rate hikes strengthen currency values as they attract capital inflows.

- Unemployment: Lower rates encourage borrowing and investment, boosting economic activity and lowering unemployment.

The Bottom Line

Interest rates reflect the cost of borrowing money and are a fundamental concept in economics, business, and finance.

Lenders apply interest rates to compensate for handing out capital that could be invested elsewhere. Rates influence consumer and business behavior.

Central banks increase or decrease rates to moderate economic growth. Understanding interest rate dynamics and their impact is essential for borrowers, investors, and policymakers.