What is an Investment Strategy?

An investment strategy is a systematic plan, approach, or methodology designed to guide investors on how to allocate their financial resources to achieve their investment goals. A thoughtfully formulated investment strategy aligns the investor’s objectives with appropriate assets and portfolios and increases the odds of achieving the expected result.

Adopting and executing an investment strategy demands significant discipline to stick to the plan that the investor set forth in the beginning. To further understand the meaning of an investment strategy, we will be sharing further details about the different types that exist, how to implement one, and how important diversification is to mitigate risks.

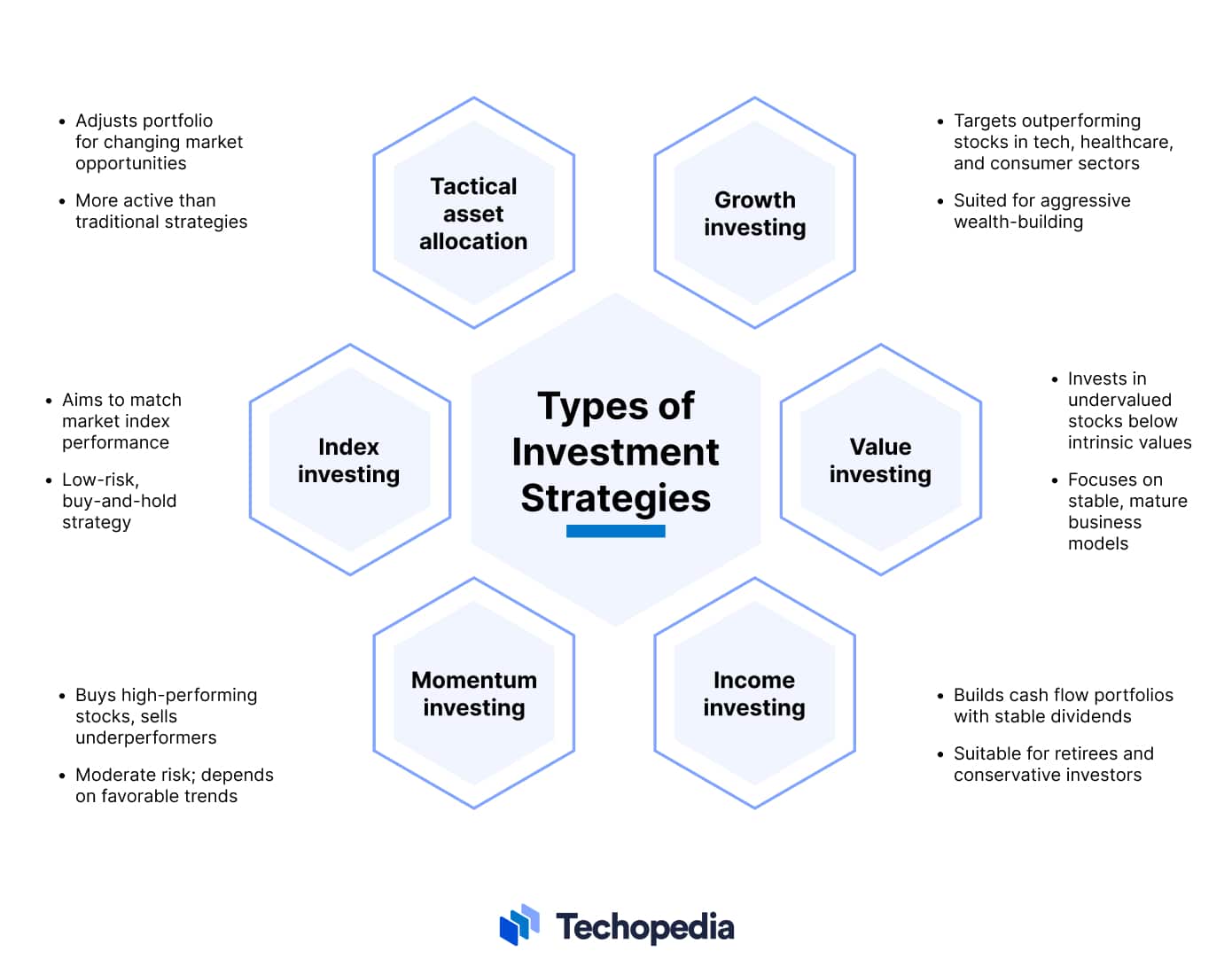

Types of Investment Strategies

Depending on each investor’s preference and plan, various strategies can be adopted and executed to generate positive results. Here’s an overview of the most common types of investment strategies.

Growth Investing

Growth investing focuses on stocks that are expected to increase in value faster than the broader market. Growth investors buy stocks from companies with promising business models in relatively early stages of their development, a large total addressable market that is relatively unexploited, or disruptive business propositions that can lead to market dominance in the long run.

Some of the most common growth sectors include technology, communications, healthcare, and consumer discretionary.

This strategy is usually adopted by investors who want to aggressively build wealth or expand the value of their portfolios by assuming additional risks.

Value Investing

Value investors aim to invest in stocks that are trading below their intrinsic values. This means that, upon assessing a company’s fair value, they compare that estimation with the price tag that the market is assigning and decide accordingly if the stock is trading at an attractive price.

They follow a contrarian approach, investing in out-of-favor companies with attractive valuations compared to underlying fundamentals. Value stocks often trade at low price-to-earnings (P/E) ratios and the companies that issue them have mature business models.

Value investors assume a certain degree of risk when building a portfolio as their assumptions and estimates can be proven wrong. However, the companies they typically invest in are stable enough to ensure that the capital invested will not be fully lost, even if things don’t go as expected.

Income Investing

Income investors build portfolios to generate a steady stream of cash that they can use to supplement or fully cover their living expenses. They invest in stocks with handsome and stable dividend yields and fixed-income assets like bonds, CDs, money market funds, and annuities with a low risk of default. Income strategies are typically suitable for retirees and conservative investors focused on capital preservation.

Momentum Investing

Momentum investors buy securities that have outperformed the overall market over the last 3 to 12 months and sell those that have underperformed, assuming that past trends will continue. High-momentum stocks are in industries that are experiencing positive macro tailwinds.

This type of strategy involves assuming a moderate risk. It can be advantageous if market conditions are favorable and investors identify the positive trend at an early stage. However, it can yield negative results if the investment is made late in the cycle.

Index Investing

Indexing aims to match the performance of a market index like the S&P 500 rather than trying to “beat” the market. Index investors believe it is hard to outperform the overall equity market consistently through individual stock selection.

These investors tend to use index mutual funds and exchange-traded funds (ETFs) to build portfolios at a low cost. Indexing is typically viewed as a buy-and-hold strategy with a long investment horizon.

Index investing carries significantly lower risks than growth or value investing as indexes tend to be highly diversified. To complement this type of strategy, investors tend to adopt the dollar-cost averaging (DCA) methodology, which involves spreading the money that will be committed to an investment over various periods to smooth the cost basis and prevent investors from engaging in market timing.

Tactical Asset Allocation

Tactical asset allocation dynamically adjusts a portfolio’s asset class mix to take advantage of changing risk-return profiles and market opportunities. It follows a more active approach than traditional strategic asset allocation based on long-term targets.

It is worth noting that investment strategies can be classified as active or passive depending on the frequency with which investors change the portfolio.

If a portfolio has a high turnover rate, meaning that the securities that compose it are being constantly bought and sold, the strategy adopted is an active one. Meanwhile, if the portfolio’s holdings hardly change over time, this means that the investor has adopted a passive approach.

How to Create an Investment Strategy?

Getting started with an investment strategy involves several steps from defining the investor’s goals to executing the required trades to build the portfolios. Here’s a quick overview of how the whole process works in practice.

1. Assess Your Investment Goals

Clearly define the strategy’s financial objectives and estimate the returns you expect to achieve. These goals may include building a retirement or college fund for the children, saving for a down payment on a house, generating income, or building long-term wealth. Conservative goals usually have shorter time horizons while ambitious goals demand assuming additional risks and significant patience.

2. Determine Your Risk Tolerance

Define your willingness and ability to tolerate a decline in the portfolio’s value and periods of high volatility. All investing involves risk. Therefore, it is important to expect an acceptable level of volatility and the possibility that drawdowns can occur. Conservative investors focus more on capital preservation rather than producing attractive returns. In contrast, aggressive investors endure more volatility in pursuit of higher long-term returns.

3. Choose the Target Asset Allocation

Asset allocation means assigning percentages to each portfolio component including stocks, bonds, cash, and other securities. The most conservative investors incorporate higher bond and cash allocations. Meanwhile, aggressive growth-focused investors typically include a higher percentage of equity instruments and alternative assets that can generate more handsome rewards over long time horizons. This allocation can change over time if the investor’s financial goals also change.

4. Select the Securities that Will Make Up the Portfolio

Research specific securities across the asset classes that will be incorporated to populate the portfolio. The best investing strategies for beginners involve buying low-cost mutual funds or ETFs as they provide diversification within equities, fixed income, and alternative assets. Individual securities require more research and monitoring.

5. Execute the Strategy

Fund the investment accounts and decide how the securities that will be added to the portfolio will be purchased – i.e. all at once, dollar-cost averaging (DCA), or market timing. Consider setting up automated purchases. Most brokerage firms allow investors to make recurring investments by linking their bank account to the brokerage account.

6. Monitor and Rebalance

Revisit the portfolio periodically to rebalance allocations to stay aligned with the original targets. This involves selling overweight assets to buy underweight ones. Make sure that no single asset class dominates the weightings. Rebalance at least quarterly or when allocations deviate over 5 percentage points from their respective targets.

Examples of Investment Strategies

Let’s look at some real-world examples of how investment strategies work.

1. Building an Actively Managed Aggressive Portfolio

Investor A aims to generate wealth by using the funds he has saved in the past 10 years. It is possible for this person to set up an individual retirement account (IRA) to save money on taxes and generate additional wealth out of those funds.

Since the goal of the portfolio is to build wealth, an aggressive portfolio allocation has been selected. This means that the investor has a high tolerance for risk. As a result, most of the portfolio will consist of instruments with a high risk-reward profile.

A hypothetical portfolio allocation for this investor would be:

- 10% – High-yield bonds

- 30% – US stocks

- 20% – Foreign stocks

- 25% – Real estate investment trusts (REITs)

- 5% – Cryptocurrencies

- 10% – Other alternative assets (private equity, fine wine, collectibles).

2. Building a Passively Managed Income-Generating Portfolio

Investor B has amassed a significant amount of money via his retirement fund. These funds must supplement his living expenses for the next 20 years. As a result, the investor needs to set up a portfolio with the primary goals of preserving capital and generating income.

To this end, the portfolio should comprise fixed-income securities that produce a predictable and reliable stream of interest and dividend payments. This investor’s tolerance for risk is significantly low.

Here’s a hypothetical portfolio allocation that could generate that kind of result:

- 30% – Investment-grade corporate bonds.

- 25% – Long-term Treasury bonds.

- 20% – Blue-chip dividend stocks (a.k.a. dividend aristocrats).

- 15% – Certificates of deposit (CDs).

- 10% – Real estate investment trusts (REITs).

Factors to Consider When Choosing an Investment Strategy

An investment strategy must be selected upon assessing each investor’s unique characteristics including his/her financial goals, employment situation, income, and risk tolerance. Here’s a summary of the key factors to consider.

| Investment Goals |

Clearly defined goals serve as a guide to pick the right strategy. Saving money for near-term purchases or the need to supplement the investor’s living expenses suggests that conservative approaches are the best alternative. Meanwhile, wealth generation and retirement savings tend to lean toward more aggressive strategies that bring in more risks and additional returns. |

| Time Horizon |

Investment duration ranges from short-term (under 3 years) to medium-term (3-10 years) to long-term (over 10 years). Aggressive investors with longer horizons aim to grow their account balances and are typically willing to accept sizable drawdowns and volatility spikes in the interim. Shorter horizons are better for conservative investors and income-generation objectives. |

| Risk Tolerance |

Determine the maximum tolerance for fluctuations in the value of the portfolio based on the ability to psychologically endure declines without feeling prompted to liquidate all holdings. A higher risk tolerance allows investors to allocate more money to equities and alternative assets while lower thresholds tilt toward fixed-income securities whose primary benefit is to preserve capital. |

Why is Diversification Important?

Diversification across asset classes, geographies, sectors, and securities is used to offset a portfolio’s volatility by avoiding concentration in too few investments exposed to the same economic risks. Combining securities with a negative correlation and whose risk/reward profiles are different contributes to this end.

What is the Most Common Winning Investment Strategy for New Beginners?

Novice investors should consider adopting the simplest passive investment strategies. This typically focuses on building wealth by buying and holding a diversified basket of low-cost index ETFs.

These vehicles provide exposure to attractive market areas but with embedded diversification as they invest in a large number of similar securities rather than a handful. Depending on the investor’s goals and risk tolerance, the asset classes, approaches, and weightings can vary.

However, overall, ETFs offer the easiest and most convenient way to build portfolios without spending hours researching individual stocks or spending thousands on a professional financial advisor.

FAQs

What is the best investment strategy?

What are the 2 major types of investing strategies?

What are the 5 golden rules of investing?

How do I learn investment strategy?