What is Islamic Coin?

Islamic coin (ISLM) is a cryptocurrency based on a profit-sharing model that adheres to the principles and guidelines of Islamic law.

In the ever-expanding market for cryptocurrencies, the debut of islamic coin stands out for its unique promise of being Shariah-compliant.

This digital asset aims to cater to the estimated 1.9 billion Muslims globally, embedding Islamic ethical and financial principles into the framework of a cryptocurrency.

But what makes it fundamentally different, and why should it be on your radar as it gears up for its ICO?

Islamic coin operates on the HAQQ Network, a blockchain infrastructure designed to be Shariah-compliant.

Today was an amazing first day at #Token2049 and we were honoured to present a keynote exploring the power of Haqq Network and the Shariah oracle to the masses. 🫡

Our booth was busy with eager partners and community members coming to share their support and ideas to develop… pic.twitter.com/AEzzw9MVB3

— HAQQ Network (@The_HaqqNetwork) September 13, 2023

Developed in partnership with Republic Crypto, the coin aims to serve a variety of purposes, including providing liquidity mining and staking options – significantly, 10% of each token issuance is allocated for philanthropic initiatives.

However, the cryptocurrency market is crowded, with over 23,000 active coins vying for attention and investment.

Islamic Coin’s specific appeal to Islamic principles provides it with a unique selling point, but time will tell how well this will translate into wide-scale adoption.

The coin has seen significant pre-launch investments, raising $193 million in private sales. While promising, these initial numbers do not guarantee the asset’s future success or utility.

The “Shariah-compliant” element entails adhering to the Islamic financial principles that prohibit practices like charging interest (‘riba’).

Here are some of the benefits of using ISLM:

| Benefit | Description |

| Shariah Compliance | ISLM is compliant with Islamic law, meaning that it does not involve any interest-based transactions or gambling. |

| Profit-sharing model | Users who hold Islamic Coins are entitled to a share of the profits generated by the network. |

| Transparency | Islamic coin could offer transparency through blockchain technology, with all transactions recorded on a public blockchain. |

| Global Access | As cryptocurrencies are accessible to anyone with an Internet connection, it makes it possible for Muslims around the world to access a financial system that aligns with their religious beliefs. |

| Improved Security | Islamic coin prioritizes user data and transaction security. |

The discouragement of speculation and social responsibility are also integral to this compliance, and islamic coin purports to fulfill these criteria.

The Debate Over Crypto and Islamic Law

Cryptocurrency’s standing within Islamic law remains contentious: on one side of the debate, some scholars argue that the volatile and speculative nature of digital currencies makes them non-compliant with Islamic law.

On the other side, proponents point to the absence of interest and the potential for financial inclusivity as aspects that could make cryptocurrencies Shariah-compatible.

Islamic Coin attempts to navigate these issues by adhering to Islamic financial principles, but the consensus on this is far from universal.

In a positive development, a fatwa – essentially a religious ruling endorsing Islamic Coin has been issued by Sheikh Dr. Nizam Mohammed Saleh Yaquby.

However, it’s worth noting that fatwas are not universally binding, and several Islamic scholars have differing viewpoints on the matter.

Market Dynamics and Scale: The Long Road to Medina

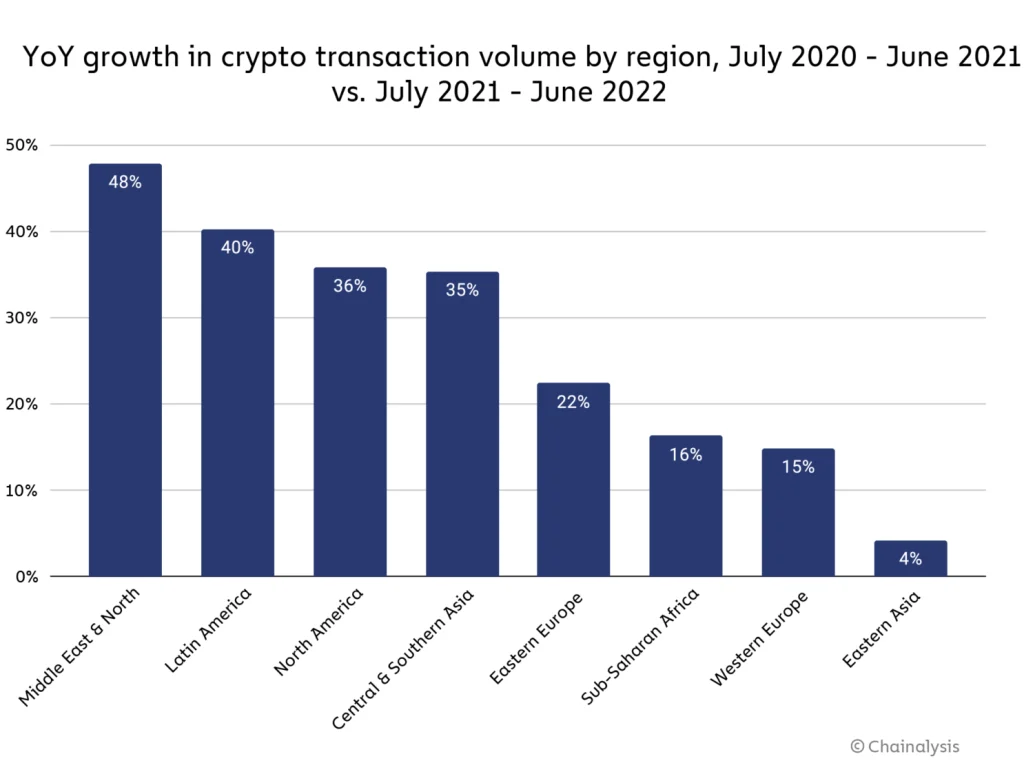

The Middle East and North Africa (MENA) region has been identified as one of the fastest-growing markets for cryptocurrencies.

If islamic coin can capture even a fraction of this emerging market, it could become significant.

However, tapping into the Islamic community is a complex task that goes beyond mere compliance with religious principles, factors like governmental regulation, acceptance among traditional financial institutions, and broad community engagement will play critical roles in determining the coin’s ultimate reach and value.

Islamic coin’s substantial initial fundraising suggests investor confidence, and its collaborations with established Islamic financial institutions hint at its ambitions.

But, as with any cryptocurrency, the risks are substantial – moreover, its unique value proposition – Shariah compliance –opens it up to scrutiny on both theological and financial fronts.

How well it can navigate these challenges while delivering on its promises of utility and philanthropy will be a crucial test of its viability.

The Bottom Line

Not because it’s promising to revolutionize the crypto or Islamic financial worlds – those remain to be seen – but because it is an intriguing test case in the ongoing effort to reconcile traditional religious values with emerging financial technologies.

Its performance could offer valuable insights into the scalability of faith-based financial products and the long-debated compatibility of cryptocurrencies with Islamic law.