What is Tokenomics?

Tokenomics, derived from the words ‘token’ and ‘economics,’ is the study of the supply, demand, distribution, and valuation of cryptocurrencies. The definition of tokenomics includes everything from the issuance and burn mechanism of a cryptocurrency to its utility and more. It is a complex and multi-disciplinary subject.

Investors study tokenomics to analyze whether a token has a sustainable economic design. A cryptocurrency can lose its value over time if its supply is too high or outpaces its demand. This phenomenon is known as inflation.

What is a Token?

A token is a cryptocurrency issued for a specific purpose or used as a form of exchange on a particular blockchain. It can have multiple use cases, security incentives, transaction fee payments, and governance which are central to the token’s demand.

In terms of supply, most cryptocurrency tokens have planned emission schedules coded in them. This allows investors to predict the number of tokens that will be circulating during a certain point in time. The emission rate and schedules are important factors in determining the inflation rate of a token.

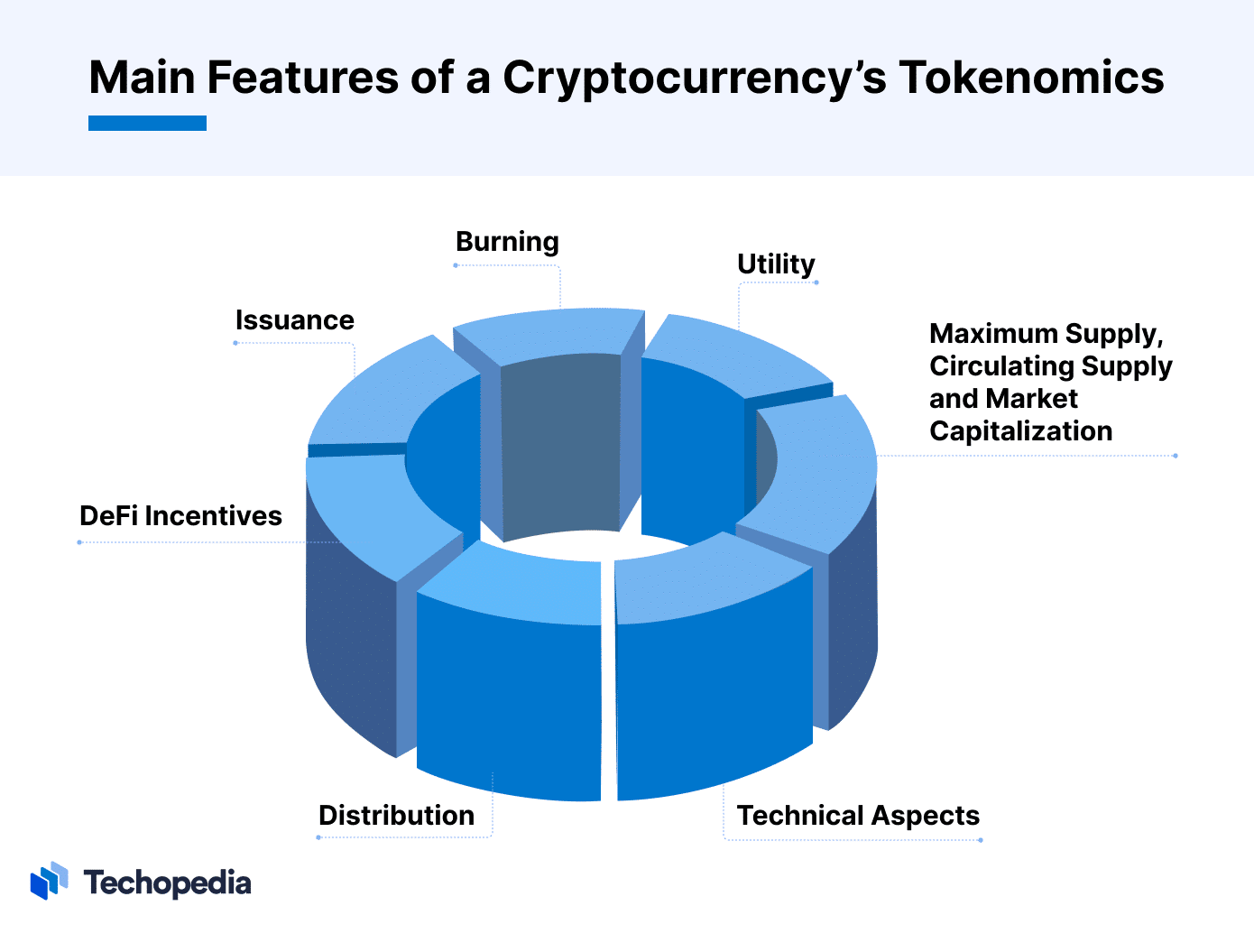

Tokenomics Explained: Main Features of Tokenomics

Let’s take a closer look at the features of a cryptocurrency that play influential roles in its supply and demand.

Issuance

Issuance is the process of creating a new crypto that did not exist before. Some of the important questions to ask when studying tokenomics are:

- How is the token issued?

- Which consensus mechanism does its blockchain follow?

Let’s take Bitcoin (BTC) and Ether (ETH) for this tokenomics study example.

The Bitcoin blockchain uses the proof-of-work (PoW) consensus mechanism. New BTC coins are created each time a miner adds a new block to the blockchain. New BTC enters circulation via miners at a pre-determined rate (we will talk about halving later).

Meanwhile, the Ethereum blockchain uses the proof-of-stake (PoS) consensus mechanism. Here, validators lock up 32 ETH in order to get the chance to validate transactions and create new blocks. Newly-created ETH is distributed to active validators at each epoch (approximately 6 minutes) based on their performance.

Other layer-one (L1) and layer-two (L2) tokens (eg. litecoin (LTC) and cardano (ADA) follow similar issuance mechanisms to BTC and ETH.

However, not all cryptos have such complex issuance mechanisms. There are several projects that create their entire token supply at genesis. The latest and most popular ICOs typically sell these cryptos.

Maximum Supply, Circulating Supply, and Market Capitalization

Tokenomics defines its maximum supply and circulating supply. A crypto can be designed to have a limited supply or infinite supply.

For example, BTC has a limited supply of 21 million coins, while the supply of ETH is infinite. BTC’s limited supply is considered among its value propositions. The coin is seen as a hedge against inflation and is also known as “crypto gold” due to its limited supply.

The circulating supply of a token is the number of coins currently in circulation. The market capitalization (or market valuation) of a cryptocurrency is equal to the product of its unit price and its circulating supply.

Distribution

You will find several crypto projects that disclose detailed summaries of their token distribution. These often distribute tokens to early investors and venture capitalists for fund-raising and to the founders and team members as incentives.

The tokens may be distributed in a phased manner with vesting and cliff periods. The emission of these tokens can impact the price of a token in case a holder chooses to dump their stake in the market.

Burning

Burning is the process of sending cryptocurrencies to an unretrievable wallet address in order to remove them from circulation.

Burning tokens can help keep inflation in check by reducing its circulating supply. Token burning can differ from one token to another. Projects may choose to burn a certain percentage of their circulation supply at random or pre-determined periods. Some blockchains like Ethereum have coded the burning of a portion of every transaction fee incurred by users.

Not all cryptos have burning mechanisms (e.g. BTC). Some can even be upgraded to introduce a burning mechanism like Ethereum did in August 2019 with the ‘London upgrade.’

DeFi Incentives

Decentralized finance (DeFi) platforms offer users returns for locking up their tokens in liquidity pools or staking pools. This process can affect the circulating supply of a token and even reduce selling pressure.

Utility

The utility of a token drives its demand, which will ultimately impact the token price, market capitalization, and even circulation supply (in the case of ETH due to gas fee burning).

For example, ETH’s demand comes from its use to pay gas fees on Ethereum. Users can not use DeFi platforms, buy NFTs, or play blockchain games on Ethereum if they do not have ETH in their wallet to pay for transactions.

Investor speculation can also drive the demand for a token. This is especially true during bull markets as investors look to make profits from trading cryptocurrencies. Other use cases of a token are payments, governance, staking, collateralization, and yield farming.

Technical Aspects

Unique technical differences can help crypto stand out from the rest.

The Bitcoin protocol undergoes an event called halving roughly every four years when the number of new BTC created with each block is cut in half. This halving mechanism ensures that BTC’s inflation falls over time.

Meanwhile, the staking of ETH has resulted in an increase in the number of dormant ETH tokens. As more ETH is locked up by stakers, fewer tokens enter the market. The decreased market supply can positively impact ETH prices.

Why Is Tokenomics Important?

Traditional asset valuation methods used to assess assets like stocks are not fully compatible with crypto investing. Each cryptocurrency comes with its unique set of monetary properties – supply, issuance, and technical aspects – therefore, investors look to study the tokenomics of a cryptocurrency before making the decision.

Investors can identify red flags, unsustainable crypto projects, and high-risk tokens by analyzing tokenomics. Some important questions to ponder over are:

- What is the utility of the token?

- Is there a natural demand for this crypto that will help survive in the bear market?

- Is the token concentration with early investors and founding members a risk to investment?

- Which token is more inflation-resistant among the sea of tokens here?

The Bottom Line

Tokenomics is a fascinating subject. It is dynamic and evolving. The field combines economics, game theory, market psychology, computer science, and more. There are so many moving pieces that investors have to analyze when studying a token.